How The Fed May (or May Not) Be Messing With Your Investments

Despite a raging global pandemic and serious economic challenges, the stock market continues it’s incredible march higher. In fact, this week, the S&P 500 officially hit a new high, topping it’s February record. Yee-haw!

But many investors aren’t buying it and feel the market’s epic (and somewhat surprising) run is being unjustly fueled by the Fed and low interest rates. So let’s unpack this thought and see what it’s all about.

Investing and interest rates

Alright, before we dive into the fun world of interest rates, let’s do a quick refresher on investing (because they’re closely related). And if you need a more complete review, check out our Investing Cheat Sheet to get started.

When you make an investment, whether it’s in a stock, bond, piece of land, rental home, or whatever, you’re buying into the promise of future cash flows.

If you buy a stock, you become a partial owner of the business. So you’ll have a claim on a portion of that business’ future earnings. When you buy a bond, you’re essentially making a loan, which means you’ll be paid interest and eventually you’ll be repaid the balance you lent. When you buy real estate, you receive the rent and can hopefully get a higher price if/when you sell the property later. All future cash flows.

Money today for more money tomorrow. And just how much money you expect to earn will be determined by the interest rate, or your “expected rate of return”.

So how are interest rates determined?

In an ideal world, the return you earn should fairly compensate you for making the investment. After all, you’re giving up your money today for the promise of getting it back later. And you’re taking some risk of not getting it back at all. More risk = higher return.

But there’s an added wrinkle.

You’re just one of countless investors out there with money to invest. And you can’t dictate what the rest of the market does. So the rate you can earn will be determined by what other investors are willing to earn on their investments.

For example, if enough other investors are willing to earn lower returns than you are, then they’ll be willing to pay more for financial assets today, which will push prices for those assets higher. (Paying a higher price today for the same cash flows in the future means your return will be lower, all else equal.)

On the other hand, if those investors get more cautious and think they should be earning a higher return, then they’ll sell. Which will drive the prices of those assets lower.

In other words, the “market” (ie the collective buying and selling of ALL investors) will determine how assets are priced, and therefore what return you can earn.

But what about the Federal Reserve?

Okay, so for the most part, the market will work that way. But the Federal Reserve, aka the “Fed” for short, also plays an important role. And this is where it gets interesting.

The Fed is the nation’s central bank, meaning it’s the banker to all other banks.

Their official job is to keep inflation under control and to ensure the economy is running at full employment. And they do it by controlling the money supply. More specifically, by raising or lowering the overnight interest rate banks use for lending to each other (called the Fed Funds Rate).

When the economy is sluggish and unemployment is on the rise, the Fed lowers the short-term interest rate to encourage banks to lend more. Businesses and individuals borrow more and the economy grows. That is until things get overheated and inflation starts to pick up. Then the Fed pumps the breaks and raises the overnight rate. The economy cools, and the cycle begins anew. This is obviously a simplified narrative, but it’s the basic idea. Fed lowers rates to stimulate, raises rates to slow.

So what has the Fed been up to lately?

Well, as you probably know, the economy has been a mess since COVID hit.

GDP fell hard in Q2 and unemployment has skyrocketed. So the Fed has been in stimulus mode, dropping rates to nearly zero and committing to purchase investments in the open market (another way to keep interest rates low).

However, the Fed has actually held rates fairly low ever since the 2008 financial crisis.

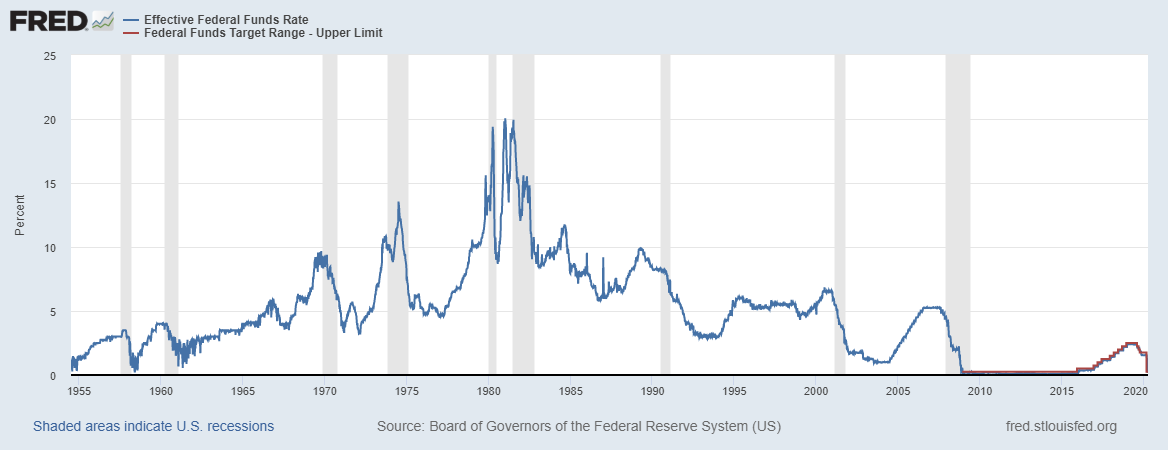

Here’s a chart showing what the Fed Funds Rate has been going back to 1955.

Without getting too bogged down in the details, you can probably see that the rate has been well below average recently. In fact, ever since the financial crisis of 2008, the Fed has kept rates pretty close to 0% (you can see the rate on the left-hand axis). The Fed started to increase it slightly a few years ago, but since COVID hit they’ve dropped it back down. Where it will probably stay for a while.

So what has the market done over this time period?

Well, since the beginning of 2009, the S&P 500 has roughly quadrupled.

Yes, quadrupled, as in 4x. Which is a massive return. Granted, it was starting at a low point after the 2008 crash, but that’s still a huge run in just a little a decade. $1,000 invested in the S&P 500 in early 2009 would be worth roughly $4,000 now (plus even more if you included dividends). Bonds and other investments have done well too.

So does this mean the Fed is the reason behind the surge in the stock market?

It’s hard to say exactly what’s behind the epic run. But there’s a good chance that low rates have impacted markets to some extent.

To be clear, the Fed’s goal is to ensure the economy doesn’t collapse and not to prop up stock prices (despite what some might claim). But there can be some unintended consequences to keeping interest rates near zero for an extended period of time.

A low Fed Funds Rate tends to have a ripple effect through the economy.

It encourages banks to lend more. So that money goes out into the economy, is spent, and then deposited back at a bank. Where it can be lent out again, and again, and again. You get the idea. Essentially the money supply expands. And that means there’s more money chasing after stocks and other financial assets, which can drive the prices up.

Investors also start to get more aggressive with their investments and become more comfortable earning lower and lower rates. Like we said before, the market will dictate what rate you can earn on your investments (for the most part). And if other investors are willing to pay up and earn lower expected returns, the prices of stocks and other financial assets will be pushed higher (for a while).

At least that’s the theory. What actually happens is a little more complicated and it’s really hard/impossible to know exactly what is causing stocks and other assets to go up or down in price at any given time.

What should you do with your money then?

Well for starters, you may want to take advantage of the low rates by refinancing your student loans, mortgage, or whatever debt you have outstanding. You’ll obviously want to look into the fine print and make sure it’s the right decision, but it’s worth checking out.

And if you’ve been looking to take out a new loan, it might be a good time to do so. But don’t just take out a loan because you can. It should make sense.

In terms of your investments, that’s a little trickier.

Rates are likely to go up at some point in the future, and when they do, it probably won’t be great for investments. But no one knows when this will happen, or how exactly it will play out. You also shouldn’t assume stocks or any other investments will crash when it happens. Again, it might play out that way, it might not.

Generally, you don’t want to be changing your investing strategy based on what you think interest rates might do. Have a long-term plan you can ride out in good environments and bad. In the end, it will work to your advantage.

Anything else we can help you with?

► What’s the big deal with GDP anyway?