Am I Saving Enough Money?

We all know we should be regularly saving money (right?). It’s the fuel that fires our finances, enabling us to accumulate wealth through investing and smart money choices.

But just how much is the right amount to save?

Here we’ll take a look at a commonly used rule of thumb and see what it means for you.

Aiming for the “20% rule”

While here’s no exact number that works for everyone, it’s often recommended that you put at least 20% of your after-tax income toward your financial priorities – priorities like growing your emergency fund and saving for retirement.

Of course, this will depend somewhat on your particular situation and goals.

If you have dreams of retiring early or really living it up in retirement (aka vacation homes, yachts, that sort of thing), then you’ll probably need to supercharge your saving rate beyond the 20%.

On the other hand, if you’re having trouble saving anything now, 20% might seem like a stretch. But don’t get discouraged by the challenge. The important thing is to get in the habit of saving something. So if you need to start smaller to get the ball rolling, that’s okay. You can build up your contributions over time. After all, it’s better to start small than not at all.

But 20%? That seems like a lot…

Well, in some ways, it is a lot. But for most of us it’s definitely doable.

Yes, it may mean cutting back on certain expenses and keeping an eye on your spending. But with a few tweaks to your current habits, you’ll quickly see your savings start to add up. And you can use those early successes to build momentum and push yourself even further. Eventually it might even become fun! (well, maybe)

Here are a couple of things you can do.

Review your credit card statements and bank statements

If you want to up your saving game, then you need to start from a place of total honesty. And that means knowing how you’re spending your money now. Yes, it might be a little painful, but it’s a must. So spend some time reviewing your credit card and bank account statements. That online subscription you forgot you still had? Those lattes you didn’t think you were buying every day? They’re on there. You need to be aware of where your money is going so you can identify where you can cut back. When it comes to saving more, ignorance is NOT bliss.

Create a budget or spending plan

Next up, you’ll need to spend some time prioritizing. Figure out what you can and can’t live without (and be honest). When you’re coming up with your plan, you do want to mind the smaller, frequent expenses, because those certainly add up. But you also want to take a hard look at your major expenses too. Granted, it’s not as easy to cut back on your rent in the short term. But most of us have an opportunity every year or two to adjust our spending in major ways. And a relatively small cut in a large expense will translate to big savings.

Start small if you have to

As we said, you don’t necessarily need to hit 20% on day one. If that simply seems out of reach right now, start with a smaller target – 10%, 5%, or even 1 or 2%. Then try to push yourself to save more. If you’re feeling too much of a financial pinch, you can always dial it back. But you might be surprised at how much you can actually put away if you make saving a priority and stick with it.

So where does the 20% come from?

There’s actually some math behind this (i.e. we aren’t just making it up). The basic idea is that if you save 20% of your after-tax income for 30-40 years and invest it at a reasonable return, you’ll hopefully have enough to be financially independent in retirement and maintain a comparable lifestyle – of course nothing is 100% guaranteed when you’re planning that far ahead.

Let’s check it out with some numbers.

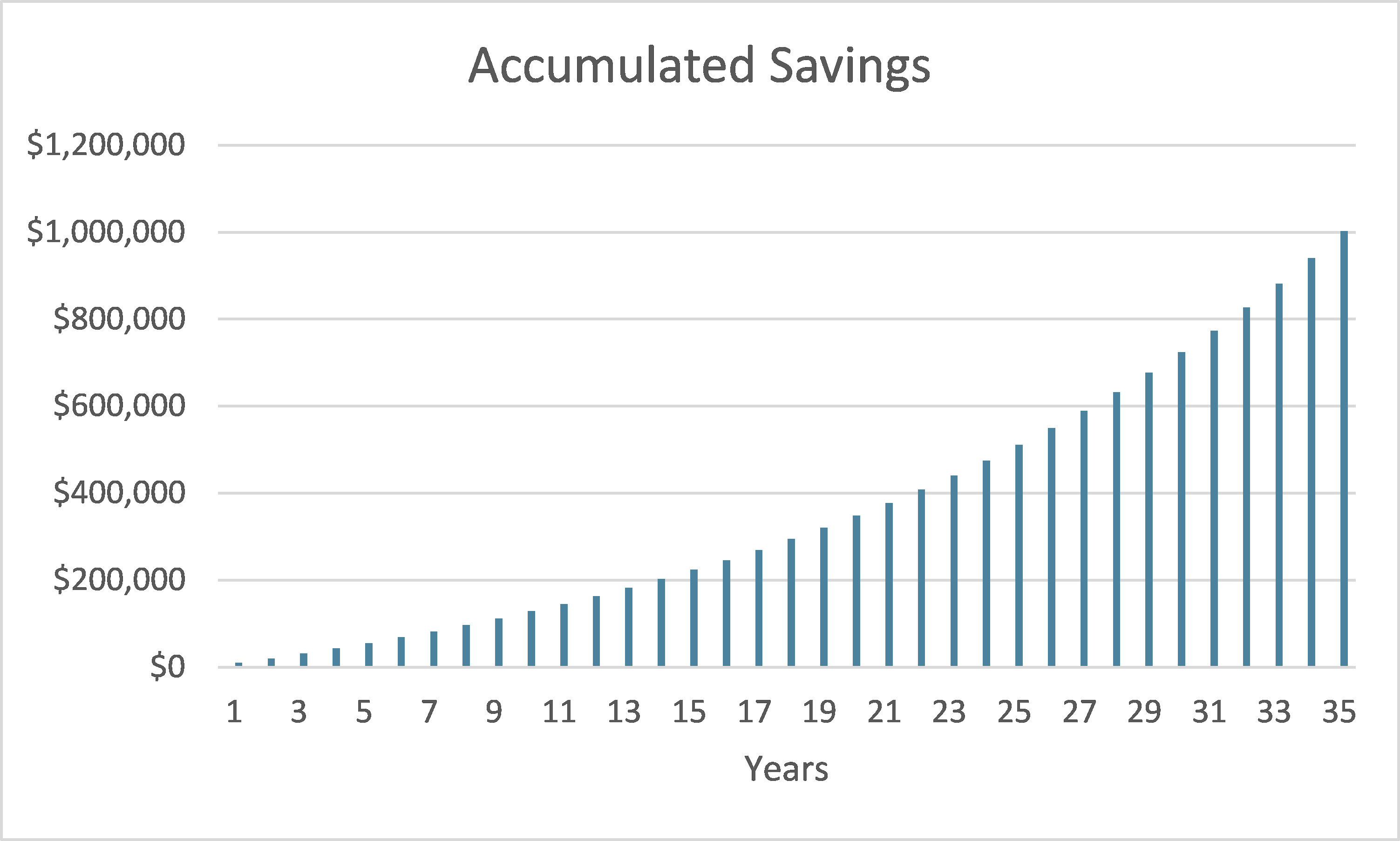

Say your after-tax annual salary is about $50k. Setting aside 20% would be $10k a year, or about $190 a week. After 35 years, assuming a reasonable investment return of 5-6% per year (net of inflation), you’re looking at a balance of roughly $1 million. (This works for other numbers too. If you earn $100k after-tax, and save $20k per year, you’d end up with roughly $2 million, etc.)

Here’s what it would look like in graph form.

(assumes annual contributions of $10,000 and a 5.5% rate of return)

Keep in mind these are fairly rough estimates, intended for illustrative purposes. For example, your salary will likely increase over time, meaning your balance will be even higher if you stick to the 20% saving rule. You get the idea though.

Also note, there’s nothing magical about the $1 million mark. But a common rule of thumb is that once you retire, you can withdraw about 3-4% of your balance each year and expect it to last throughout your retirement. So with a balance of $1 million, you could reasonably withdraw about $30k to $40k a year, which is about how much you would be spending now from your $50k salary.

Again, these are rough numbers. It will also depend on a number of factors, like how long you live, how your investments perform now and in retirement, how much you get from Social Security when you retire, what lifestyle you plan on living, etc. But it gives you the general idea.

Can’t I wait and set aside more later?

We know it’s tempting to put off saving until the proverbial “later”. Especially when you’re young and just want to have fun! Wooooo! Look, we get it. Life is short, and we need to live it.

But this is one area where you really don’t want to procrastinate. Even small amounts will add up over time. And getting in the habit of setting money aside is just a good idea. Not to mention, those small amounts will earn interest, so the longer they sit untouched, the more they’ll grow.

Okay, how do I start?

In addition to what we’ve already mentioned, there are a couple of things you can do to ensure you’re actually setting aside some money (because we all know it’s easier said than done):

Take advantage of direct deposit

With direct deposit, your paycheck will get deposited directly into your bank account. So if it never hits your hands, you’ll be less tempted to spend it right away. And what’s really cool about direct deposit is that you can even direct a portion of it to various accounts you set up for specific purposes – like a dedicated emergency fund. We can even walk you through how to automate your finances if you need more help.

Sign up for that 401(k)

If your employer offers a 401(k) (or a 403(b) if you work for a non-profit), this can be a great way to start saving and investing your money. Like direct deposit, you decide what portion of your paycheck goes into this retirement account (pre-tax contributions). And some employers even offer a matching program, meaning they’ll contribute money in addition to what you put in. It’s essentially free money so you should take advantage of it if you can. If you want to learn more about setting one up, we have you covered.

And if your employer doesn’t offer a 401(k), don’t sweat it. You can always set up an IRA (Individual Retirement Account) on your own, which is similar. We can help you with that too.

What if I’m already saving 20%?

That’s great! Keep up the good work. It’s always important to celebrate your successes.

But there’s no need to stop there. Don’t be afraid to push yourself to save more. After all, the more you save, the sooner you’ll hit your financial goals. Which means you’ll have even more time and energy to focus on the things your really care about.

Looking for more?

Automating your finances to save more