Credit 101 – Breaking down the basics

Your credit is an essential part of your financial life, directly impacting your ability to borrow money and so much more. But understanding how it all works can be a challenge. So let’s break it down to the basics.

Here’s what we cover in this guide

What is credit

Understanding your credit score

What factors impact your credit

Your credit report and how to check it

How much does your credit matter

Establishing credit

Beyond credit scores

What is credit?

Without getting too philosophical, credit is all about trust. Specifically, it’s the trust that a borrower (ie you) will repay a loan to a lender.

To state the obvious, lenders, like banks and other financial institutions, are in the business of making loans. In order to do so, they need to be able to assess the risk of a borrower, meaning the chances of not being paid back.

So for you the borrower, this risk will then influence the interest rate they charge. A higher risk borrower means the lender needs to be compensated by charging a higher interest rate, all else equal.

This means having good credit will be key to ensure;

1) You’re able to get a loan in the first place

2) When you do, you’ll get as low a rate as possible

So how do you make sure you have good credit?

Understanding your credit score

The first step in ensuring you have good credit is to know your credit score, a standardized metric lenders use to compare borrowers.

The most commonly used credit score is something called a FICO Score, which ranges from 300 (weak credit) to 850 (strong credit).

FICO is a for-profit business, so they don’t disclose exactly how they calculate their scores. But they do disclose what factors feed into the equation, which we’ll get to soon.

And while FICO scores may be the most common, they aren’t the only scores out there.

Depending on where you’re getting your score, you may be seeing one that’s based on a slightly different scoring system. These systems tend to be similar though. And most scores range from around 300 to around 900. Typically, anything above 700 is considered “good” credit.

Which brings us to another important question – how do you actually check your credit score?

It used to be more challenging to see your own credit score as a consumer. But these days most banks and credit card providers will share some version of your score with you for free.

There are also a number of online services that provide credit monitoring for free or for a relatively small fee. Again, these might not be your official FICO score. But they tend to be reasonably accurate substitutes, and are probably good enough for general monitoring purposes.

What factors impact your credit score?

As we mentioned, FICO doesn’t disclose their exact formula for calculating a credit score. But they do provide some general guidance about the five main factors and how’re they’re weighted.

Here’s what they are.

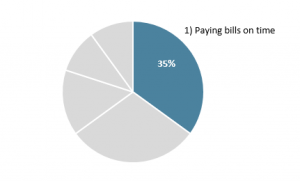

#1 Factor – Paying your bills on time (35% of your score)

The most important factor is your payment history, meaning whether or not you pay bills on time. Late payments hurt your score. So the main punchline is, the best way to improve your credit or keep it strong is to be sure to pay your bills on time.

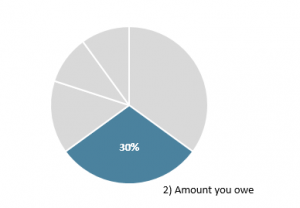

#2 Factor – The amount you owe (30% of your score)

Coming in a close second is the amount you owe, which includes your total amount of debt and the number of debts you have. While having an excessive amount of debt can hurt your credit, having none at all is not necessarily the best either. It’s generally good if you have some debt and can demonstrate you’re able to make your payments on time.

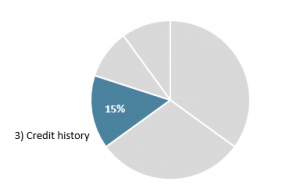

#3 Factor: Your credit history (15% of your score)

The length of your credit history also matters. Generally speaking, longer histories are better, unless of course you have a troubled credit past. A short history is not necessarily bad though if you pay your bills on time and keep your debt balances under control.

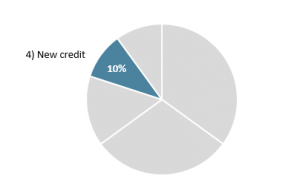

#4 & 5 Factor (it’s a tie!): New credit (10% of your score)

If you open several new credit accounts within a short time period, it can hurt your score (since it might look like you’re desperate for money). You usually don’t want to have more accounts than you need. So don’t go around opening accounts unnecessarily.

#4 & 5 Factor (it’s still a tie!): Types of credit and debt (10% of your score)

Your score generally benefits from having different types of credit (mortgage, credit cards, car loan, etc.), assuming you are managing them well and making payments. But this doesn’t mean you should randomly take out new loans hoping to improve your score. Again, don’t have more accounts than you need. Be smart about it.

Long story short, the exact way your credit score is calculated is a little complicated, but the takeaway for you doesn’t need to be.

If you want to improve your credit score or keep it strong, you’ll basically want to focus on paying your bills on time and avoid taking on too much debt.

And if you aren’t happy with where you credit is now, don’t get discouraged. No, you can’t magically improve it overnight, but if you take the right steps and stick with it, you will see real improvements. Be patient.

Your credit report and how to check it

At this point, you’re probably wondering, “hey, if my credit score is based on my personal information, how does that information gets collected in the first place?”

Well, wonder no more.

This is where the three credit agencies, or credit bureaus, come in – Equifax, Experian, and TransUnion. They’re in the business of collecting credit information about individuals and then providing it to lenders in a credit report.

Your report will include personally identifying information, like your name and social security number, and also information about any loans or credit accounts you have outstanding, including your payment history (whether or not you’ve been good about making payments).

But your credit report is NOT actually an assessment of how creditworthy you are. That’s what a credit score is for. Your report is just a place where the information is gathered and reported.

To be more precise, you actually have three distinct credit reports, one for each of the three credit agencies. And although the information should be similar, it can sometimes vary from one report to another. It’s actually not all that uncommon for some of this information to be incorrect, which could then be hurting your score.

So by law, you’re entitled to see each of your three reports for free every year, which you can do at AnnualCreditReport.com. This is the official credit report website authorized by the government.

We also have a step by step guide on how to check your credit report for free.

It’s a good idea to periodically check your credit reports, and to check all three since one could contain errors even if the others don’t.

When you check, look for anything that seems suspicious, like:

-Unfamiliar accounts

-Incorrect debt balances

-Accounts listed as late but that you have been paying on time

-Credit inquiries you didn’t authorize

If you find any errors, you can dispute them through that particular credit bureau’s website or you can use this link to MyFICO.com and follow the directions.

How much does your credit actually matter?

Always a great question to ask. Let’s take a look at a real life example: buying a home.

Chances are, if you’re going to buy a home, you’ll need to borrow money with a mortgage. And this means your credit score will come into play.

First off, we should point out that if your score is too low (roughly 620 or lower), you might not even be able to get a mortgage at all. But that’s a pretty short conversation. So let’s say your credit does meet the necessary threshold and you are able to get a mortgage. Your credit score will then influence what interest rate you can get.

Just how much your credit score impacts your mortgage rate will depend somewhat on the bank, but according to FICO, the difference can be as high as 1.5% between low credit and high credit borrowers. At first glance, this might not seem like that much. But when you consider the size of a typical mortgage, it can/will add up to serious money.

For example, a difference of 1.5% in interest for a $200,000 loan would equate to about $200 per month, or over $75,000 over the life of a 30 year loan (serious money). And for a $300,000 loan, the difference would be about $100,000 over 30 years (even more serious money). You can literally save tens of thousands of dollars by having good credit.

Your credit can also impact you in ways beyond borrowing. Employers and landlords sometimes run credit checks on potential employees and renters as a way to gauge responsibility. And utility providers, like cell phone or cable companies, might also run credit checks on potential customers before initiating service. So don’t let bad credit keep you out of your dream apartment…or even worse…keep you from getting that sweet new cellular phone.

But what if I don’t have any credit yet?

It’s the classic credit catch-22; lenders and credit card providers may be hesitant to offer you credit if you don’t have a credit history. But you need credit to build a history in the first place.

If this sounds familiar, don’t panic just yet. There are solutions.

Some credit card providers specialize in offering cards to people with no or limited history, which can be a great place to start. You’ll likely be given a small credit limit on these cards, but that’s alright. As you prove yourself creditworthy by paying your bills regularly, you’ll be able to increase your credit limit over time.

You could also consider a few other alternatives, like…

• Setting up a joint credit account with someone with existing credit. This will give you access to credit so you can start building a history, while the credit card provider can take comfort in knowing the other person will be there to pick up the bill if you aren’t able to.

• Getting a secured credit card. With a secured credit card, you basically contribute money in advance by making a cash deposit. Once you’ve demonstrated your ability to make payments on time, you’ll be in better shape to apply for an unsecured credit card.

• Asking a landlord or utility provider to report your payment history to the credit bureaus. If you already have an apartment and utility accounts, you may be able to use your payment history to establish credit. There are even some services that will help you do this.

Overall, it’s important to establish credit when you’re young and then work towards building it up.

Beyond credit scores

We should also mention that when it comes to your credit, your credit score is not necessarily the final word. If you apply for a credit card or a loan, banks will often use their own credit assessment tools and will probably incorporate other factors that aren’t captured in your credit score, like your job history and your income.

So yes, your credit score is important, it just isn’t the whole story.

In general, if you stay on top of your finances, you’ll also be building and maintaining strong credit, no matter what metrics a lender might use to measure it.

Anything else we can help you with?

See how to check your free credit reports

Learn about refinancing your student loans