Conquering Your Debt

About 10 minutes

In recent years, financial innovations have made life easier in many ways, from banking and investing to paying our bills with a click of a button.

However, not all innovations make us better off.

And the sad truth is, consumer lending has made it easier than ever for us to over-extend ourselves financially. But all is not lost. With a reasonable plan and a determined effort, anyone can turn a dire debt situation into a story of success.

So if you’re struggling now, or just feel like you could be doing better, it’s time to take charge of your debts once and for all.

Here’s what we cover in this guide

Assessing your current situation

Addressing the root cause

Creating your plan

Reaching out to lenders

Considering refinancing

Be wary of debt consolidation

Bankruptcy as a last resort

Next steps

Step 1. Assessing your current situation

You can’t make progress if you don’t know where you stand today. So start off by taking an inventory of all your debts and loans.

And yes, this may be uncomfortable, especially if you’re feeling overwhelmed by your debt. But putting it off will only make the situation worse. It’s best to face your challenge head on.

Your list should include everything – student loans, any outstanding credit card balances, auto loans, home mortgage, really whatever debts you have. Write down the current balance of each and also the interest rate you’re paying. If you do have a mortgage, put an asterisk next to it, because you may want to treat it slightly differently, which we’ll come back to shortly.

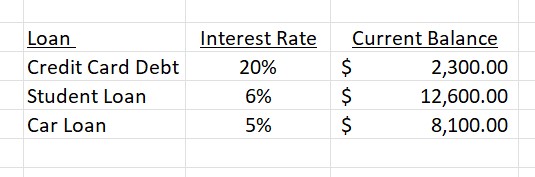

Here’s an example of what your list might look like.

Keeping track of your loans in a spreadsheet will make it easier to manage the data and run various calculations. Microsoft Excel or Google Sheets are two good options.

Next, you’ll want to figure out just how much debt you have relative to your income.

So add up all your debts and divide by your annual after-tax income.

This is your debt balance-to-income ratio. It gives you a sense of just how serious your situation is and is something you’ll want to track over time. Obviously the higher the ratio, the greater your debt burden, and the more serious the situation.

Example: If you have $25,000 of debt and your annual after-tax income is $50,000, then your debt balance-to-income ratio would be 0.5.

As we mentioned, if you have a mortgage, you may want to exclude it from the calculation, or do a separate calculation without it. While it’s still debt, it may not be quite as urgent to pay it off as quickly as your other debts. We cover this in more detail in our guide on homes and mortgages.

Also keep in mind, your debt balance-to-income ratio is different from your debt payment-to-income ratio, which you calculate by adding up all your monthly loans payments and dividing by your after-tax monthly income.

You’ll want to know this number too since it tells you how much of your income is going toward debt payments, which will be helpful when you’re creating your budget. Tracking both of these numbers over time will give you a sense of how much progress you’re making.

Step 2. Addressing the root cause

Knowing how much debt you have is just the beginning. You’ll also want to understand why you’re in debt. And not all reasons are the same.

If you recently finished college or graduate school and are diligently working to pay off your student loans, that’s one thing. A lot of people are in the same situation. And as long as you’re making steady progress, there’s less immediate cause for concern. Keep at it.

But, if you’re in debt because you’ve been living beyond your means, that’s a different story. You’ll need to address the problem before you do anything else.

It’s time to end the behaviors that got you here in the first. You’ll need to tighten up your spending and figure out a saving strategy that works for you.

And depending on your current situation, you may need to make some fairly drastic changes. We’ll be honest, this probably won’t be much fun. But struggling with debt day in, day out is no way to live. You owe it to yourself to get out of debt and to start now.

Step 3. Creating your plan

Different strategies work for different people. So you’ll have to design a plan that works for you. But generally speaking, there are two basic approaches to paying down your debts – paying off your highest interest debt first, or paying off your smallest balance debt first.

Approach 1. Focus on your high interest debt first

Technically, paying off your high interest loans first gives you the biggest bang for your buck. Because the sooner you pay them off, the less interest you’ll be paying every month. And that means more money for other things, like your retirement account.

Even more importantly, if you currently have high-interest debt – we’re talking credit card debt or other personal loans – you’ll want to pay it down ASAP.

Interest on these loans can reach as high as 20% (or even more), which means it would only take four years (or less) for your balance to double. It’s also not enough to only make the minimum payments. That’s just the amount you need to pay to avoid additional late fees. You’ll still be charged interest on your balance.

And to be clear, you obviously still need to keep paying the required scheduled payments on your lower interest loans. But in terms of paying down balances, it’s probably best to start with your debts charging the highest interest.

Approach 2: Pay off the smallest balances first

Based on the math alone, paying down your highest interest debts first makes the most sense. But that’s assuming you actually stick with it. Which may be easier said than done.

In fact, a 2012 study at Northwestern University’s Kellogg School of Management actually showed that people who paid off their debts with the smallest balances first were more likely to pay off their debts overall. The belief is that the sense of accomplishment you get from paying off a loan in full will motivate you to keep going.

Clearly the psychological side of personal finance is real and powerful – we have an entire guide dedicated to it. So this “snowball approach” is definitely worth considering. But strictly based on the numbers, it’s better to pay down your highest interest debts first. And again, if you have high-interest debt, you’ll absolutely want to make paying it off a top priority.

Ultimately though, you’ll need to figure out an approach that works for you.

As you do, these are a few other things that may help.

Consider reaching out to your lenders

If you’re really having a hard time getting out from under your debt, it might be worth reaching out directly to your lenders. They may be willing to work with you, either by lowering your interest rate or possibly forgiving a portion of your debt.

Sure, it may be awkward, and there’s certainly no guarantee they’ll budge. But sometimes they’re willing to negotiate, especially if they’re concerned you won’t be able to pay off your debts at all. Again, you may not get anywhere, but it usually doesn’t hurt to ask.

What about refinancing?

Let’s say you have an existing loan, but you could now get lower interest or better terms on a new one. This is when refinancing might be an option.

When you refinance, you essentially take out a new loan to pay off your old one.

Typically this only makes sense if interest rates have gone down since you took out your loan, or if your credit has improved and you can negotiate better terms. However, even then it’s not always a no-brainer. You’ll need to factor in any additional costs of refinancing, like loan fees, which will vary depending on your particular loan.

Some loans will also have a prepayment penalty when you refinance. So you’ll want to check first and factor that in too. This can apply to some mortgages, although most will allow you to prepay up to 20% of your balance each year. By law, all student loans are exempt from prepayment penalties, so you can’t be charged for paying them off ahead of schedule.

Be wary of debt consolidation

The basic idea with debt consolidation is to bring all of your debts together in a single loan, somewhat similar to how refinancing works. It’s often advertised as a cure-all for your financial woes. But you know better than to believe in financial miracles by now.

Sure, consolidating can be helpful if you’re able to negotiate a lower interest rate. So it’s sometimes worth considering, but that’s not the end of the story.

Debt consolidators obviously don’t work for free, which means you’ll need to factor their fees into your overall equation.

Also, they may try to make your debt payments seem more manageable by extending your loan further into the future. So even though your monthly payments might technically go down, the total amount you end up paying could actually increase.

On top of this, you may be required to post your home or car as collateral to back up your credit. And doing so puts them at risk if you can’t keep up with your payments. Generally speaking, this is something you really want to avoid.

We don’t want to say consolidating can’t work for you. But more often than not, you’re really just reshuffling your debt rather than reducing or eliminating it. And sometimes you might actually increase it. Always remember, anything that seems too good to be true usually is.

Turning to bankruptcy

So let’s say you’re really stuck and just know there’s no way you could possibly climb out of debt. Then it might be time to consider bankruptcy.

Filing for bankruptcy is the legal process of seeking protection from your creditors through the court system. Despite the social stigma, there’s no shame in resorting to bankruptcy if you really need to. After all, that’s what it’s there for.

You certainly don’t want to make the decision lightly though. Filing for bankruptcy will significantly impact your credit and your ability to borrow money in the future. But on the other hand, if you’re heading in that direction, delaying won’t be smart either. You can end up draining financial accounts that might be protected from your creditors when you file. There’s no point in delaying the inevitable if it really is inevitable.

We aren’t going to get into the details here, and you’ll want to speak to a lawyer before you think about filing. But it’s important to remember that it’s there if you need it.

I’ve paid down my high interest debts, now what?

That’s great! You’re already in better financial shape than a lot of people. Keep up the good work.

Once you’ve paid off your high interest debt (or hopefully never had any in the first place), you can keep chipping away at your other debts, like student loans or a mortgage. You still want to pay these off, but since they typically charge lower interest rates, it’s not quite as urgent.

And hopefully you’ll be saving a meaningful amount of your paycheck, which means you can use that money to pay down your debts ahead of schedule, build an emergency fund, and save for retirement. We can even help you balance these priorities if you want to learn more.

Key Take-Aways

1) Start by assessing your current situation to see where you stand now. Then you can develop your plan for getting out of debt.

2) Why you have debt matters. If you’re in debt because you’re living beyond your means, you need to address the root cause first.

3) Based on the numbers, it’s best to pay down your highest interest rate debts first, but there may be be a psychological benefit to paying off the smallest balances first.

4) Refinancing can be a good idea if your financial situation has improved and/or you’re able to negotiate a lower interest rate on your debts.

5) Be careful with consolidating. It won’t likely reduce your total debt, just reorganize it, and may result in additional fees and higher lifetime payments.

Sign up to see the rest of this article!