The Mathematics of Recovering from an Investment Loss

Dan Nastou, CFA

Let’s face it, gains are the fun and exciting part of investing.

The allure of big gains (or even just keeping up with inflation) is a draw for many of us and an important reason why investing is a great way to passively build your wealth over time.

But losses are part of the process too, whether we like it or not.

And sometimes the math required to reconcile those losses isn’t always intuitive. It’s tempting to think that to recover from a loss of X%, you just need to follow up with an equal X% gain. While that’s roughly true for very small percentages, it doesn’t hold up for larger losses.

Let’s say you hold an investment that falls by 10%, from $100 to $90. Since you’re now starting with $90, you actually now need a gain of 11% to get back to your original $100 (10 is roughly 11% of 90). And the larger the percentage loss, the larger the gain needed to break even.

And a few more examples…

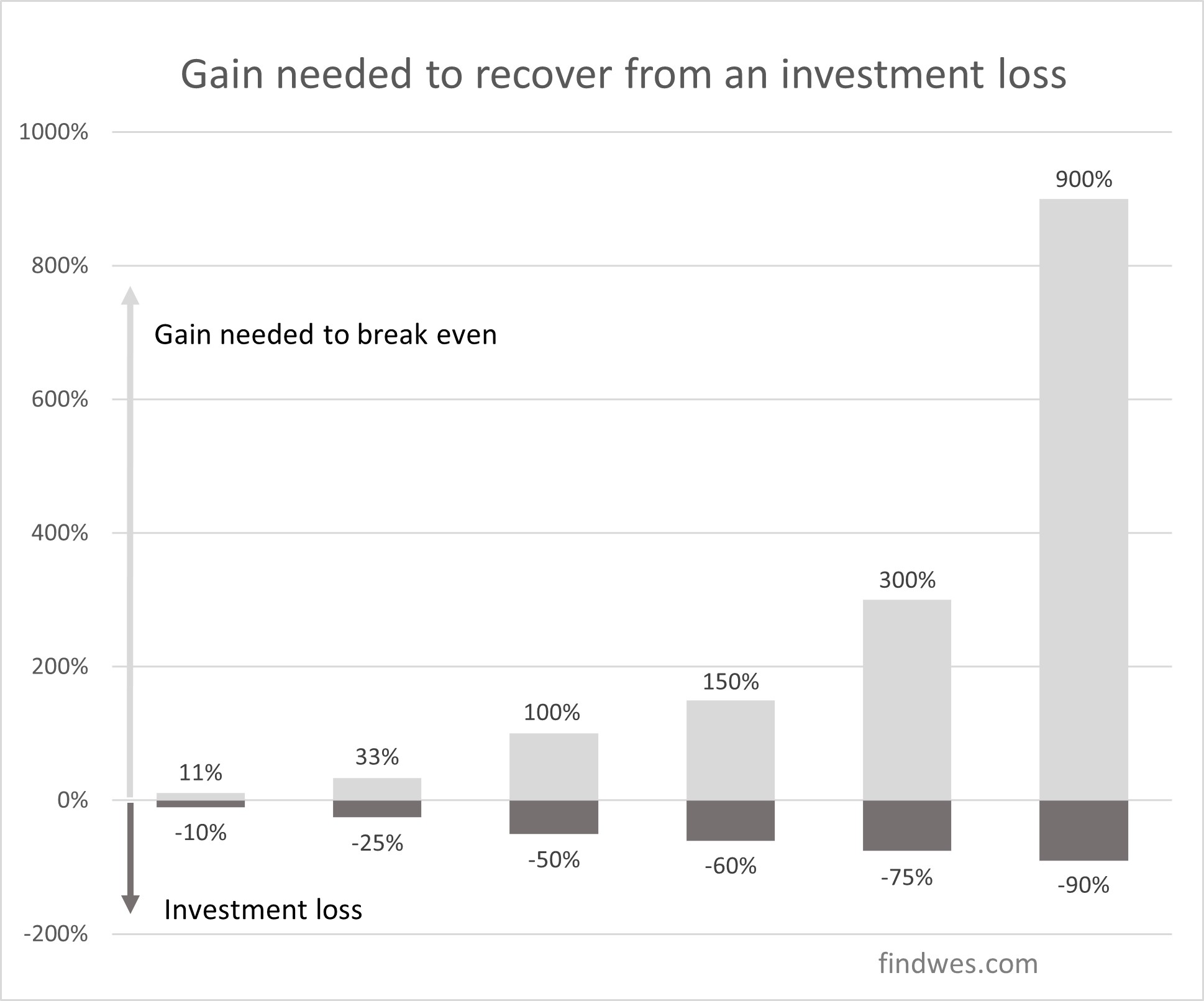

Here’s a chart showing what percentage gain you would need to get back to your starting amount for various losses.

Take a minute to let these implications sink in.

So for example, if you’re down 50% on an investment, then you would need to double your new capital base (a gain of 100%) just to get back to even.

And for larger losses, recovering can become almost insurmountable.

A loss of 75% requires a 300% gain to just break even. And a loss of 90% requires an incredible gain of 900%! And while these may seem extreme, losses that large can and do happen. For example, during the 2000 dotcom crash, the entire Nasdaq index fell by roughly 80%. And for individual stocks, it happens much more frequently.

So yes, those big gains are exciting and can be worth pursuing. But avoiding large, permanent losses is just as critical when it comes to growing your money over the long run.