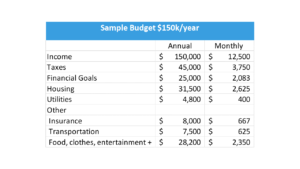

Sample Budget at 150k/Year

By Dan Nastou, CFA

Understanding the concepts of personal finances is key to a healthy financial life. But it’s also helpful to work through examples with actual numbers.

Here we’re going to outline a sample budget for someone earning $150,000 a year.

Keep in mind, this is just an example and should not be viewed as a recommendation. You’ll want to consider factors that are unique to you when coming up with your own budget. Alright, disclaimer over. Let the budgeting begin!

Starting amount: $150,000

Taxes

First off, we need to account for taxes. After all, they’re unavoidable if you’d like to stay out of jail. So taking into account federal income taxes, FICA taxes, and state and local taxes, you’ll probably be paying about $40,000 – $50,000 a year on income of $150,000.

Your state and local taxes will of course vary by where you live. And your federal taxes will vary based on your deductions. But we’re working with rough numbers here to keep it simple and easy to follow. So we’ll use $45,000 to be in the middle of the range.

Amount remaining after taxes: $105,000

Financial goals

The point of all this is to help you build wealth. So it’s important you make this a priority by regularly setting aside a portion of your income for financial goals.

This would include saving for an emergency fund, investing in a 401(k) or IRA, saving up for a down payment on a home, paying down your loans ahead of schedule, or any combination of these.

We generally recommend trying to save at least 20% of your after-tax income. This would equate to $21,000 for the year or $1,750 a month. If you simply can’t manage this much, you can start out with a smaller amount and build up over time. But be sure to keep pushing yourself.

In addition to this, let’s also account for any regularly scheduled debt payment you might have, like student loans. For this example, let’s assume $30,000 of student loans, charging 5% interest with a term of 10 years. This equates to a monthly payment of about $320, or $3,800 a year. Let’s round up to $4,000 a year to keep it simple.

So that’s savings/investments of $21,000 a year, and another $4,000 for student loans. Totaling $25,000. (Obviously if you don’t have student loans, you would add back the $4,000)

Amount remaining after financial goals: $80,000

Housing

Housing will likely be your largest expense. And it will vary significantly depending on where you live, type of home, whether you have roommates or live alone, etc.

However, for the sake of this example, we’re going to assume a housing spend equal to 30% of after-tax income. (Actually a frequently recommended rule of thumb). This would equate to $31,500 for the year or $2,625 a month.

Amount remaining after housing: $48,500

Utilities

Next up are utilities. This would include things like electric, gas, water, heat, phone, internet, cable (if you have it). Some of these may already be included in your housing expense, so don’t double count them.

And of course this will also vary depending on where you live and whether you live alone, but let’s assume this totals about $400 a month, or $4,800 for the year.

Amount remaining after utilities: $43,700

Other living expenses

At this point, we’re left with $43,700 for other living expenses, or $3,642 per month. Sure, you won’t be living a jet setter life, but that’s okay, we’re working with what we have.

So let’s break this down a little more.

Insurance

Some employers will cover your health insurance, or at least a portion of it. But some don’t. If you have to purchase it on your own, you’ll likely be looking at several hundred dollars a month for an individual, or a few thousand a year. This will depend on where you live and what insurance plan you choose. Some have lower monthly premiums and higher deductibles and vice versa. You’ll also want to consider disability insurance, and life insurance if you have children.

Transportation

This might include car payments, gas, public transportation, cabs/ride shares. Whatever gets you from point A to point B. Again this will depend on where you live and how you prefer to get around. But it’s reasonable to assume a few hundred dollars a month for transportation.

Food, clothes, entertainment, other

We’re down to about $2,000 – $2,500 per month for food, clothing, entertainment, and various other expenses, or about $500 – $625 per week. If you don’t have student loans or you get your insurance through work, you’ll have significantly more money left over for this category.

At this point, you might be tempted to lower your savings rate and increase your spending. But again, try to get in the habit of regularly setting aside some money for your financial goals. Even if you have to start small and build form there. Get creative, find ways to cut back on expenses, and become a money saving master!

Pulling it all together

Here’s how this budget might look in a spreadsheet. Keep in mind, your numbers might be slightly different since this is just an example.

Summary

There’s no “right” budgeting formula that will work for everyone. If you’re just supporting yourself, then living on a $150,000 income and setting aside money for your savings shouldn’t be too hard. If you have children to support, it will be more of a challenge, but definitely doable.

The key is to figure out a strategy that works for you, find ways to manage your expenses, and make sure you regularly set aside at least a portion of your earnings for your financial goals. And don’t get discouraged. Good things take some time.

Anything else we can help you with?

Check out our investing cheat sheet

How to save more money with automation

How to refinance your student loans