Traditional IRA vs. Roth IRA

If you’re investing for retirement, an IRA can be a smart choice. But before you sign up, you’ll you’ll need to decide between a traditional IRA and a Roth IRA. We’re to help you understand the ins and outs of each.

Here’s what we cover in this guide

Traditional vs Roth, what’s the difference

Understanding IRA eligibility

Taxes now vs taxes later

A few more things to consider

Traditional vs Roth, what’s the difference?

Each type of IRA offers a tax benefit, making them attractive investment accounts, but they work a little differently. The main difference is in how and when you pay taxes.

With a traditional IRA, your contributions are tax-deferred, meaning you can contribute money directly from your paycheck without paying income taxes (in other words, your contributions are tax-deductible). Then your money can grow tax-free, meaning you won’t owe any investment taxes along the way. When you do start taking the money out in retirement though, your withdrawals will be taxed as income.

With a Roth IRA, you contribute after-tax money, meaning you pay taxes on your income now, but your money can then grow tax-free and won’t be taxed again when you take it out in retirement. So, taxes up front, but no taxes later.

Understanding IRA eligibility

Both types of IRAs have certain eligibility rules and contribution limits. For starters, the total annual amount you can contribute to your IRA (traditional, Roth, or both even) is $6,000, or $7,000 if you’re 50 or older (amounts as of 2022).

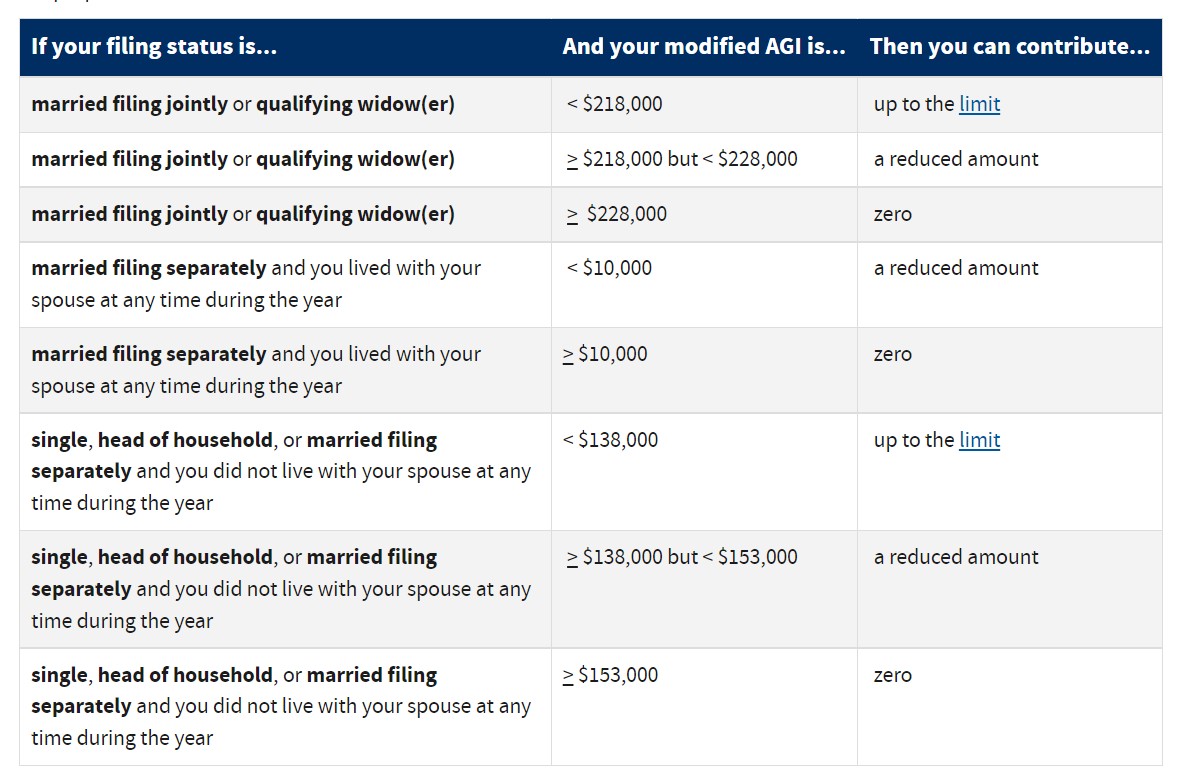

With a Roth, your contribution limits will also be based on your income level. The following table is taken directly from the IRS website.

Your AGI, is your adjusted gross income, which is your gross income (i.e. all the money you bring in) minus certain adjustments that might reduce it, like IRA contributions and self-employed health insurance expenses. To get your modified AGI, you would add back certain deductions. Often your AGI and modified AGI will be the same or close.

So based on the table, if you’re single, and make $153,000 or more, you can’t contribute to a Roth IRA. If you make less than $138,000, you can contribute up to the full limit. In between those two it will be a reduced amount.

Traditional IRA tax deductions

Unlike a Roth IRA, anyone can invest in a traditional IRA, regardless of income. But if you or your spouse are covered by a workplace retirement plan, like a 401(k), then the amount you can deduct on your taxes for IRA contributions may be limited based on your income. You can read more at the IRS website. Even without the tax deduction, a traditional IRA can be a good way to save for retirement, it just becomes less attractive.

Taxes now vs taxes later

If you are eligible for both types, how do you decide which one to go with?

This basically comes down to whether you think you will be in a higher or lower tax bracket when you take the money out in retirement relative to today.

If you think you’ll be in a higher tax bracket in retirement, a Roth might make sense – remember, you pay taxes when you get paid and then your contributions and investment returns won’t be taxed again when you take the money out. For a lot of young people with relatively low income, this could be the case, making it an attractive option.

If you think you’ll be in a lower tax bracket in retirement, then a traditional would probably make more sense – no taxes now, but you’ll pay taxes on your contributions and investment returns when you take the money out in retirement. This might apply to higher earners who expect to move down to a lower bracket when they retire.

Of course this is hard to know for certain. Your future tax bracket will be based on how much money you’re making off your investments in retirement, and some people actually end up in a higher tax bracket because of their investment income – although that’s usually a good problem to have.

Also keep in mind, tax brackets are subject to change over time, and it’s possible they’ll be higher or lower in general by the time you retire.

So if you aren’t quite sure, you could consider putting some money in each, as long as you stay within the overall limit.

Ultimately, both options are good for building wealth.

A few more things to consider

Taking money out early

For the most part, you probably won’t want to take money out of your retirement accounts before retirement. It’s usually best to leave it and let it grow. But if you do need to take some out, traditional and Roth IRAs differ with respect to how it works.

With a traditional IRA, if you take money out before you’ve reached the age of 59 and a half, you’ll be hit with a 10% penalty and you’ll have to pay taxes on the money you take out. (However, there are a few exceptions though, like if you use the money to pay for education or if you take out $10,000 for a first-time home purchase).

With a Roth IRA, since you’ve already paid taxes on your contributions, you won’t be hit with a penalty or tax for taking them out early. However, the money you’ve earned in your account from investing may be subject to a penalty and tax. To avoid it, you’ll need to have had your account for at least 5 years, and qualify for certain exceptions, like a first time home purchase.

Required distributions in retirement

Traditional and Roth IRAs also differ with respect to requirements for taking your money out during retirement.

With a traditional IRA, once you reach the age of 72, you must to start taking required minimum distributions, whether you want to or not and regardless of whether you are actually retired. You also can no longer make contributions to your account.

A Roth IRA is more flexible. You aren’t required to take distributions and you can continue to make contributions for as long as you want.

Summary

Whether you choose a traditional IRA, Roth IRA, or both, you’ll want to make investing for retirement a regular part of your finances. And both types of accounts offer some compelling benefits. The most important thing is to start saving and investing early and to keep at it, regardless of which you choose.

Learning More: If you want to learn more about Roth and traditional IRAs, we recommend checking out the official IRS website.