Why Financial Losses Feel So Painful

By Dan Nastou, CFA

Okay, obviously it doesn’t take a genius to point out that financial losses are painful. Clearly no one likes losing money. We’ve all been there and we all know how it feels.

But there’s an interesting psychological phenomenon that suggests the pain we feel from a financial loss is actually greater than the pleasure we feel from a gain of equal size. Psychologists call it loss aversion, and it’s worth exploring. So let’s do that!

What is loss aversion?

Simply put, loss aversion refers to the notion that we feel losses more acutely than gains of equal size, particularly when it comes to our finances.

The term was first coined by psychologists Daniel Kahneman and Amos Tversky in a 1979 paper on decision making where they studied the behavior of participants who faced various potential outcomes of losing and gaining money. The (simplified) result was that people tended to avoided losses rather than seek gains.

As the authors succinctly put it in their now famous research, “losses loom larger than gains.”

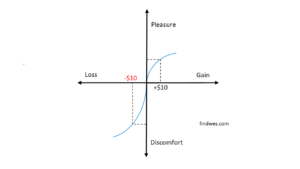

Represented graphically, the concept looks something like the image below. The blue curvy line approximates the relationship between our emotions and gains/losses, with financial gain (positive) and loss (negative) measured on the horizontal x-axis and pleasure (positive) and discomfort (negative) measured on the vertical y-axis.

For illustrative purposes we’ve labeled a gain of $10 and a loss of $10 but the exact numbers aren’t the focus. What’s more important is the general shape of the curve. Note that the financial loss corresponds to a larger emotional impact than a gain of equal size.

How strong is the effect?

This can be a little tricky to quantify, but in later research, Kahneman and Tversky suggested the “loss aversion coefficient” might be around 2. This means for every $1 of potential loss, a person needs to be enticed with $2 of potential gain. Or losses are twice as impactful as gains.

Of course anytime we’re dealing with human psychology it can be difficult to pinpoint quantities precisely. And it seems likely that it may depend on the specific situation and what’s at stake.

Some researchers have even pushed back on the theory entirely, proposing the observations may simply be capturing a different phenomenon altogether. But a large body of follow-up research has supported the initial findings. Some of it has documented a biological impact on the brain while experiencing gains and losses. And some has even shown that monkeys exhibit loss aversion behavior. Yes, monkeys. So it seems fair to say there’s probably something to it all.

So why does loss aversion really matter?

This is where it gets even more interesting. Because loss aversion isn’t just something studied in a lab. It can potentially impact our real world behavior in a number of important ways.

First off, when it comes to investing, it likely means we feel the losses more acutely than the gains. No matter what we invest our money in, there will inevitably be ups and downs along the way. And if those downs feel extra painful, it might tempt us to behave in ways that potentially hinder long-term wealth building.

For example, during a market downturn, the loss may be so emotionally painful we feel like we just can’t handle it (the joyful gains we experienced before weren’t worth this agony!) and sell out at exactly the wrong time, only to see the market recover and reach new highs later. And it may even encourage us to take excessive risks in hopes of recovering from those extra painful losses.

Additionally, marketers have also learned to use it to their advantage by framing offers in terms of loss rather than gain. Free trials that we don’t want to “lose” and ultimately pay for, limited time coupons and discounts (don’t miss out!), and pre-orders are just some of the sales tactics.

In other words, if left unchecked, loss aversion may lead us to make sub-optimal financial choices.

Knowing ourselves, and doing something about it

The key words in that last sentence were “if left unchecked.” But loss aversion and other psychological forces don’t need to remain unchecked. And they certainly don’t need to derail our goals. Because if we’re aware of these potential biases and take reasonable steps to manage them (or potentially even harness them), then we can significantly improve our chances of success. But it does mean we need to take action.

So get proactive and develop a systematic approach for your money that works for you.

There are any number of methods to consider. You can take advantage of automation to save and invest more while reducing the emotional factor. Maybe start a journal tracking your financial thoughts and emotions. You can work with an advisor, or connect with a buddy and hold each other accountable for your decisions. Be creative.

Long story short, there are countless ways to keep your financial emotions in check. You just need to figure out what works and stick with it. Building wealth takes time, and some work, but it’s something every one of us can do, emotions and all.

More on behavioral finance

Daniel Kahneman was eventually awarded the Nobel Memorial Prize in Economic Sciences in 2002 for his work in behavioral economics (Tversky had sadly passed away by then so he wasn’t eligible for the prize).

Needless to say, it’s a big topic, and we’ve only scratched the surface here. We cover some more in our Core Content, and there’s plenty more to learn on your own. A good place to start is Kahneman’s book Thinking, Fast and Slow, where he covers loss aversion and a number of other concepts. But there are a lot of other great resources out there too, so get after it!

As always, this is education, not financial advice. Talk to your financial professional if you need help or are thinking about making changes to your investments.

References

Tversky, Amos and Kahneman, Daniel. (1979). “Prospect Theory: An Analysis of Decision Under Risk,” Econometrica, 47, 263-291.

Tversky, Amos and Kahneman, Daniel. (1991). “Loss Aversion in Riskless Choice: A Reference Dependent Model,” QuarterlyJournal of Economics 107(4), 1039-1061.

Chen M.K, Lakshminarayanan V, Santos L.R. (2006). “How basic are behavioral biases? Evidence from capuchin monkey trading behavior.” Journal of Political Economy. 114:517–537.

Tom Sabrina M, Fox Craig R, Trepel Christopher, Poldrack Russell A. (2007). “The neural basis of loss aversion in decision-making under risk,” Science; 315:515–518.

Looking for more?

Check out our investing cheat sheet

How to save more money with automation

How to refinance your student loans