Why it Might Be a Great Time to Refinance Your Student Loans

School’s out (literally). And if you’re now gainfully employed, earning a little cash, and haven’t gone completely crazy from home isolation yet, you might be able to save some money by refinancing your student loans.

As we cover in our overview of student loan refinancing, the basic idea with refinancing is to replace your existing loans with lower interest loans that will cost you less money over time.

For the most part, you can do this when 1) you’ve finished school and started working and lenders view you as a safer investment or 2) interest rates have come down. Ideally you can hit both of these. So where do things stand now?

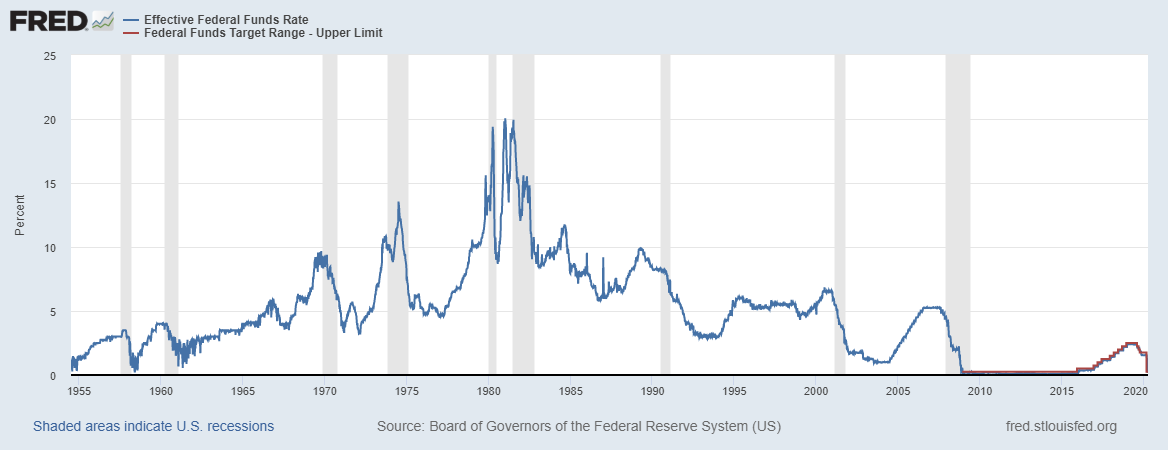

Interest rates are pretty low right now. Like really low.

Interest rates in general have been low for a while now (compared to historical rates). And they’ve come down even more since the Fed just cut their target rate to a range of 0% – 0.25% two weeks ago. Here’s a cool graph from the Federal Reserve (it goes all the way back to 1955!). You can see the recent dip down to nearly 0%.

Keep in mind though, this rate (called the “federal funds rate”) is just the rate banks lend to each other overnight. So businesses and individuals can’t actually borrow at that rate (sadly). But it does influence what rate consumers can get. And typically, a lower fed funds rate will roughly translate to lower student loan rates, even if it’s not exact.

But you might not want to ditch your federal loans

Before you do anything though, you need to consider whether you have federal loans or private loans (or both). When you refinance, you can only refinance into a private loan, not into a new federal loan. And federal loans offer certain benefits you might not want to lose, like forbearance, deferment, income-driven repayment, and loan forgiveness. These can be some pretty nice protections if you need them.

Also, the government has recently taken action to offer relief to federal student loan borrowers during the coronavirus pandemic.

First, the President and the Department of Education announced that all federal loan borrowers will have their interest rates dropped to 0% for 60 days and borrowers will also have the option of suspending payments for at least two months.

Then, as part of the $2 trillion economic stimulus/relief plan (aka the CARES Act), this 0% interest period was extended from 2 months to 6 months (through Sept 30, 2020).

You shouldn’t have to do anything to take advantage of the 0% interest – interest charges should stop automatically. But you probably still want to check in with your loan servicer to be sure.

Be sure to shop around for the best offer

If you are considering refinancing, or if you just want to see what’s out there, you’ll want to shop around for the best offer. You can check out online lenders, or brick-and-mortar banks (although it’s not ideal timing for that).

Or you can use a third party comparison site like Credible.com. (This is one of the few “advertisements” we allow on our site because with think it offers a useful service.) Credible doesn’t actually lend any money, but they’ll help you compare real offers from lenders that you’re likely to qualify for, and without incurring a hard credit check. So it’s worth checking out their site.

Again, if you need a more general overview of refinancing, we have you covered.

Anything else we can help you with?

► Learn about the new IRS tax deadline (July 15th)