Inflation and How it Works 💸

About 7 minutes

Have you ever heard how a candy bar only cost a nickel back in the day?

First off, that sounds amazing. But unfortunately, it would be tough to find a deal like that today. And as you can probably guess by now, the reason for the change in price over time is…..inflation. Inflation is a major force in the economic world and one we all need to understand.

Here’s what we cover in this guide

What is inflation

How inflation works

Mostly a long term problem

Understanding purchasing power

Real vs nominal numbers

Real interest rates

Learning from history

Deflation and decreasing prices

Protecting against inflation

What is inflation?

Yes, it can also mean blowing up an odd-looking balloon man for stock photographs (see above). But here we’re talking about the general increase in prices of goods and services over time.

Why does this happen?

Well, inflation can be caused by a few different things and often there’s some debate about what’s causing it at any given time.

But primarily, as the supply of money in the economy increases over time, the prices of goods and services will rise. Think of more dollars chasing after the real stuff in the economy – more and more dollars are competing for that stuff, so everything starts costing a little more.

Of course the amount of goods and services produced in the economy generally increases over time too. However, the supply of money usually outpaces it. In fact, the government actually tries to have a small amount of inflation, typically about 2-3% per year. That’s because when prices rise a little every year, consumers are generally willing to spend their money rather than wait for better prices later. And this helps the economy run smoothly. At least that’s true as long as inflation remains relatively low and stable.

Additionally, inflation spikes can be caused by periodic shocks to supply or demand that temporarily drive prices higher (a drop in supply, a jump in demand, or both). Usually these shocks get worked out over time and this form of inflation will eventually subside.

In general, it’s safe to assume there will be some amount of inflation every year. But just how much can vary from one year to the next.

How it works

The math behind inflation is actually very similar to how compound interest works. Except instead of your investment balance or debt balance increasing over time, it’s the prices of goods and services that are increasing.

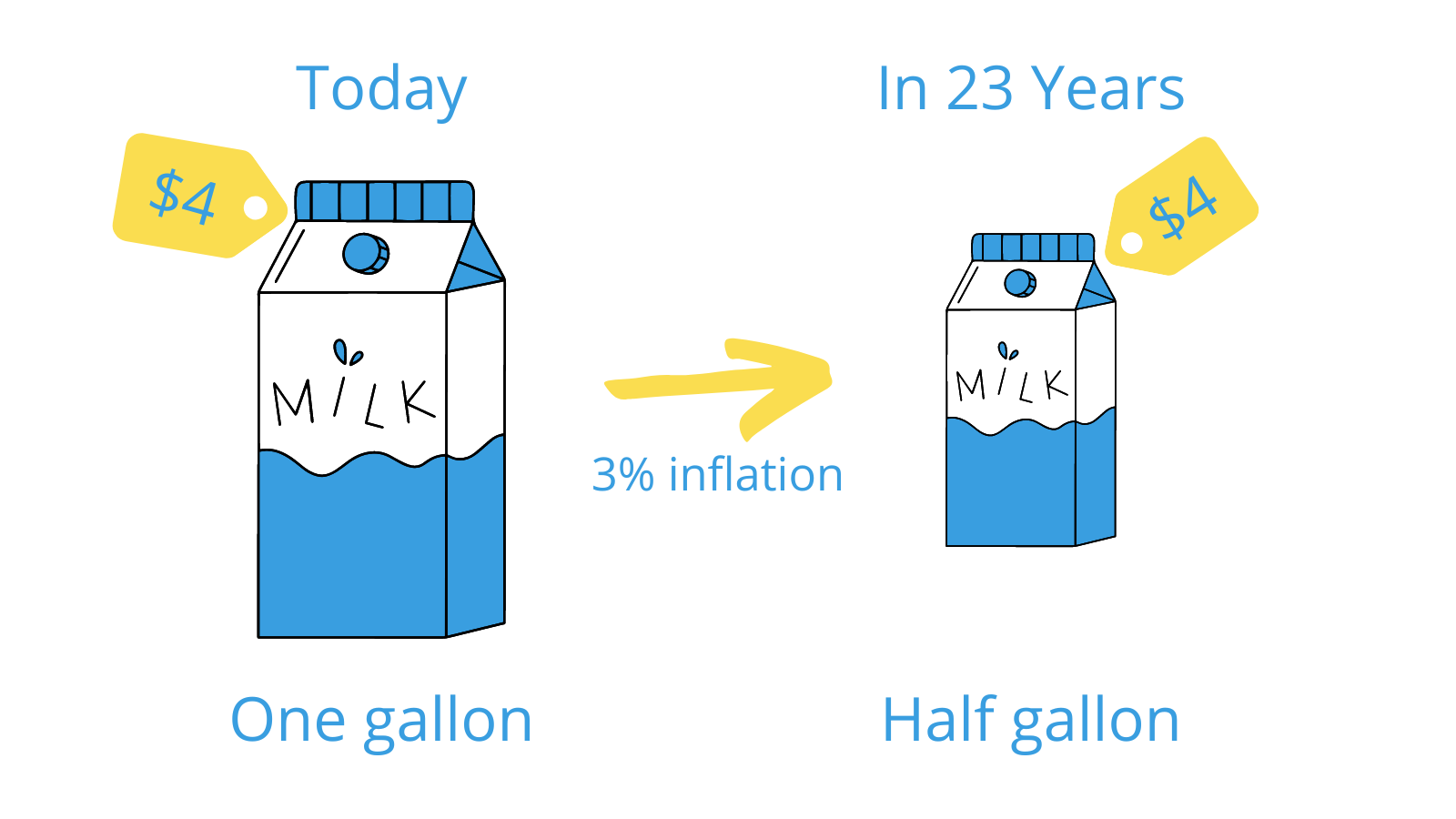

Example: Take an every day item like a gallon of milk. Suppose it costs $4 today.

Now let’s get wild and also say the rate of inflation is 3% a year (actually, it’s not so wild, 3% inflation is a reasonable estimate based on history).

This means you would expect the price of milk to increase by 3% over the course of a year.

So at 3% inflation, the price of one gallon a year from now would be $4 x 1.03 = $4.12.

Now, you’re probably thinking a twelve cent increase doesn’t seem like all that much. And of course it isn’t all that much. But when you consider that everything else you buy will probably be increasing in price too, it’s going to add up.

Also, and even more importantly, after a few years, that annual increase of 3% will really start to look like a lot of money.

At this rate, the price of milk will double in about twenty three years.

Let’s say you set aside $4 today with the intention of buying milk, but for some reason you forget about the money for twenty three years. When you finally go to the store, you would only have enough money to buy half as much. Everything has doubled in price! Aside from you becoming the Rip Van Winkle of dairy products, this would not be good.

Mostly a longer-term problem

Alright, of course twenty three years is a long time to wait to buy milk. But when it comes to investing your money and planning for retirement, it’s actually not that long.

If you start investing in your twenties, thirties, or even forties, you’ll probably be investing for much longer than twenty years.

Also, we only assumed 3% annual inflation, which is actually fairly mild. If inflation was 7% a year, it would only take 10 years for your money to lose half of its value. Even at 3% over 10 years, your money will have lost about 25% of its value.

Key Point: The longer the time period, or the higher the inflation rate, the larger the impact inflation will have on your money.

Focus on your purchasing power

Since inflation changes the value of money over time, we need to think in terms of something called purchasing power. This is a measure of what your money can actually buy, rather than focusing only on the dollar amount you see in your bank account.

Inflation can be sneaky. And sometimes we don’t even think about it. We often check our savings accounts or investment accounts and see the balance has increased. At first glance this seems great. But then when we take into account the negative impact of inflation, we realize they’re not actually growing quite as much as we thought. And they may even be shrinking in value.

Yes, kind of scary.

For example, if inflation is 3% a year, you would need to earn 3% a year on your money just to maintain your purchasing power, meaning just to be able to buy the same amount of stuff next year as you can today. The actual value of your savings would not have increased at all.

And if your money grows by less than 3%, the value of your savings will actually decrease.

Tracking purchasing power with real numbers

To track your purchasing power, you need to adjust for inflation by converting nominal numbers to real numbers.

This may sound complicated, but it really isn’t (no pun intended).

Money that has not been adjusted for inflation is referred to as nominal. It’s what the money is worth in name only, not in value. This is the number you see whenever you check your various account balances. If you have $1,000 sitting in a bank account, it has a nominal value of $1,000. If you check again next year and it’s still $1,000, it still has a nominal value of $1,000.

Money that has been adjusted for inflation is referred to as real. It measures what you can really buy with your money after accounting for inflation. It tracks the value of your money. If you have $1,000 sitting in your bank account and it’s still sitting there next year, but inflation was 3%, its real value would have decreased by 3%.

This concept is really important over longer periods of time.

For example…

Let’s say someone offers to give you $100,000 in ten years. Great deal!

But how much will that actually be worth by then? Well, that will depend on how much inflation we experience over the next ten years.

At 3% inflation, that $100,000 will be worth roughly $75,000, in today’s dollars. In other words, its nominal value will be $100,000, but its real value will be $75,000 in today’s dollars. You always need a reference point when you’re talking about real vs nominal numbers (why we say “today’s dollars”). So this means that having $100,000 in ten years will be roughly equal to having $75,000 today if inflation is 3%.

If inflation is only 2%, that $100,000 would be worth about $82,000 in today’s dollars. The lower inflation, the less of a difference in value over time.

At 7% inflation, that $100,000 would be worth only about $50,000 today. The higher inflation, the larger the difference.

This way of thinking is essential for long-term planning because we need to think in terms of what our money will be worth, not just the dollar amount.

Real interest rates – how money really grows

The same line of thinking (real vs nominal) can be applied to interest rates. Interest rates that have been adjusted for inflation are called real interest rates. And when it comes to tracking your money over time, it’s the real value that you want to pay attention to.

How to do it: To convert a nominal interest rate (which is what you would be given or told) into a real interest rate, you subtract the rate of inflation from the nominal rate.

Example: Suppose you earn a nominal return of 7% on your investments over the course of one year, meaning your account balance grew by 7% (not counting any new money you put in). But now let’s say inflation was 3% for the year. Then your real return was only about 7% – 3% = 4%. So yes, your money has grown by 7% over that year, but its value has only grown by 4%. You can really only buy 4% more stuff with your money than you could have last year. Still, not a bad deal, but not quite as much as you may have expected.

This conversion from nominal to real rates is technically only an approximation, because the exact math is a little different. But it works fairly well with relatively low levels of inflation, like we tend to see in the U.S.

Learning from history

Over the past 30 plus years, inflation in the U.S. has generally been fairly low and stable, remaining around 2-3% per year. This isn’t terrible, but still something you need to consider for long-term planning.

However, inflation can get uglier, in fact, a lot uglier.

During the 1970’s and early 1980’s, annual inflation exceeded 10% at times. At 10% inflation, your cash would lose half of its value in just 7 years. And while 10% inflation seems pretty bad, it can actually get much worse than that even.

From 1921 to 1924, Germany experienced extreme inflation, or hyperinflation, which at one point became so bad, prices of goods doubled within days! With that level of financial instability, paper money became virtually worthless, resulting in widespread financial hardship.

Our point here isn’t to keep you up at night worrying about the inflation boogeyman, but to point out that inflation can pose a real risk to your finances and it’s something you need to pay attention to and account for with your long-term plans.

Finding the data: If you want to look up actual inflation rates, you can check out the U.S. Consumer Price Index, or CPI, at the Bureau of Labor Statistics website. We also have a separate guide breaking down the history of inflation in the US.

Deflation and decreasing prices

It may sound a little strange, but inflation rates can also be negative at times. Negative inflation means the value of money is increasing with time (you can buy more with a dollar in one year than you can today). Not too surprisingly, this is called deflation.

At first glance, it may seem like money becoming stronger over time is a good thing, but deflation can actually be a big problem.

When this happens, people tend to wait to buy things, and this causes the economy to slow and can lead to an ugly downward spiral of lost jobs and declining wages.

While periods of deflation are typically less common than inflation, they do occur.

Beginning in the 1990’s, Japan experienced roughly two decades of deflation, meaning its money, the Yen, became stronger over time. And this contributed to some major economic problems. The US has even had several deflationary periods over the past century.

Just as with inflation, you should be aware of the effects of deflation because it can impact how certain investments perform and how your wealth changes over time.

Alright, so what can I do about inflation?

Over time, inflation will erode the value of your money, so you’ll want to be proactive in two important ways;

1) Pay attention to it and account for it in your planning. Don’t forget inflation is always there, and be sure to factor it into your financial plans, especially for longer term goals. In other words, think in terms of your purchasing power. So when you’re estimating future financial needs, like money you’ll need in retirement, recognize that its value will likely be lower than it is today.

2) Make sure your money grows at a faster rate. This is sometimes easier said than done. But for most of us, investing in wealth generating assets like stocks, bonds, and real estate will likely be the best way to make sure your money outpaces inflation. We’ll cover more details in the sections on investing, specifically in the sections on Investing Risk and Investing Portfolios.

Key Take-Aways

1) Inflation is the general increase in prices of goods and services over time.

2) Over time, inflation will cause your money to lose value.

3) Focus on your purchasing power, which represents what your money can actually buy.

4) Real interest rates have been adjusted for inflation. They represent the growth rate of purchasing power.

5) Over long periods of time, inflation can have a significant impact on the value of your money.

Sign up to see the rest of this article!