Diversification!

About 6 minutes

You’ve probably heard people talking about diversifying their portfolio, or something to that effect. But what exactly does that mean anyway? Let’s get into it.

Here’s what we cover in this guide

Spreading your bets

Reducing volatility

Generalizing diversification

Spreading your bets

Simply put, diversification is all about managing risk. Has someone every told you not to put all of your eggs in one basket? Well, that’s diversification in a nutshell (or eggshell?). The basic idea is that if you spread your eggs across multiple baskets, you’ll be less likely to break them all at once.

Good advice for anyone carrying eggs in baskets these days. But it’s also an important concept for your finances, especially when it comes to investing.

We’ll cover the fundamentals of investing in more detail later, but it’s important to understand that while investing helps us build wealth, it always carries some risk. No matter what you invest in, whether it’s stocks, bonds, real estate, whatever, there’s always a chance you could lose money.

Diversification helps you reduce this risk. By spreading your money across a number of investments, each individual investment will only represent a relatively small portion of your wealth. So if one of them gets into trouble, the bulk of your wealth will still be secure.

But diversification also protects your wealth in a more subtle way too.

Reducing financial volatility

In addition to protecting you from a single bad investment, diversification can also help reduce how much your investments fluctuate in value over time.

Let’s see how it works with an example.

Suppose you have $100 to invest and you have three choices of what to do with it (we’re keeping it simple for now).

Option 1. You can invest it all in Stock A

Option 2. You can invest it all in Stock B

Option 3. You can split your money between the two

Again, don’t worry if you aren’t quite sure what a stock is. We’ll cover the specifics later.

For now, let’s suppose Stock A and Stock B each cost $50 per share. Since you have $100, you can either buy two shares of Stock A, two shares of Stock B, or one share each. Here’s a visualization of what your three choices would look like.

Since we can’t predict the future, let’s suppose Stock A and Stock B are expected to perform equally well. In other words, we’d say they have the same expected return.

Let’s also say they’re equally risky, meaning they have an equal chance of going bust and also their prices will fluctuate about the same amount from one day to the next.

Basically, there’s no clear winner. So, in theory, you should be indifferent between the two.

One month later

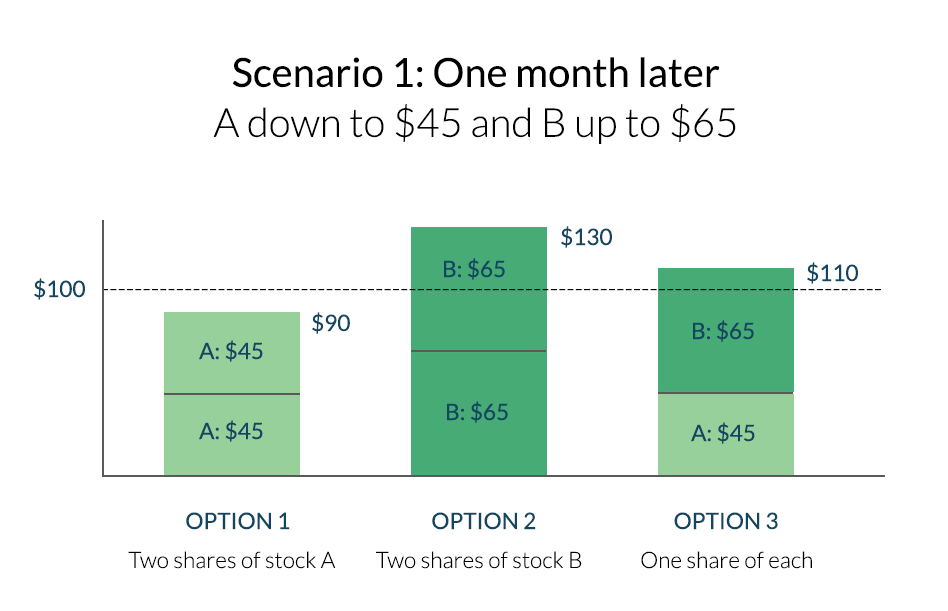

Now let’s say a month has passed. The prices of the stocks have changed – Stock A has decreased to $45 per share while Stock B has increased to $65 per share.

If you had gone with Option 1 and bought two shares of Stock A, your $100 would now be worth $90 (two shares worth $45 each). But had you gone with Option 2 and bought two shares of Stock B, your $100 would be worth $130 (two shares worth $65 each).

If you had gone with Option 3 and bought one share of each, your $100 would be worth $110 ($45 plus $65). Clearly you would have clearly done better with two shares of B, but you would have also done worse with two shares of A.

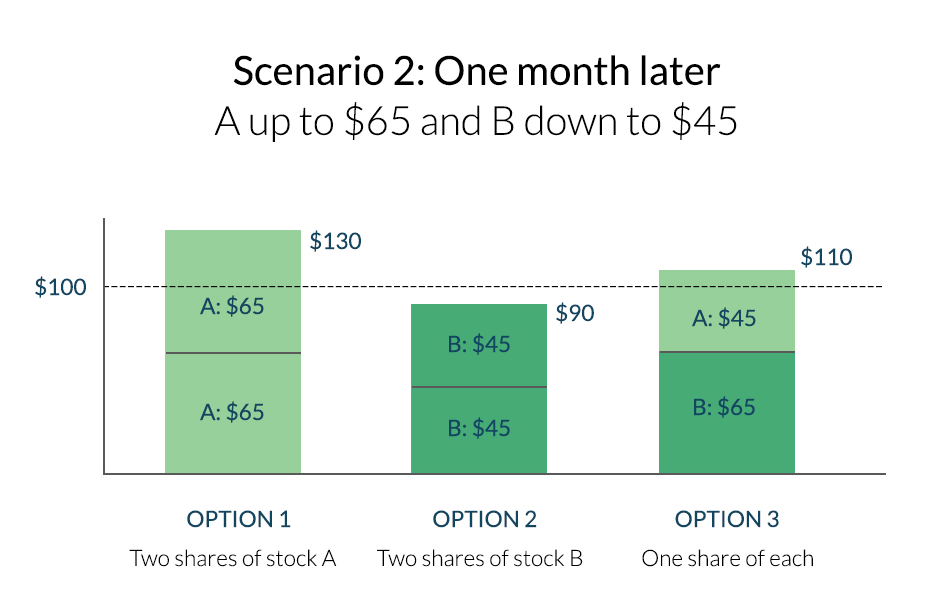

But what if the the opposite had happened and Stock A was now worth $65 and Stock B was worth $45. The outcome would be reversed and Option 1 would have outperformed Option 2. But you would still have $110 if you owned one share of each – the more diversified portfolio.

And remember, we said there was no way of knowing in advance which stock would do better. In all likelihood, that’s generally how it will be when you’re choosing investments. But by buying one share of each, you would have reduced your chances of losing money.

In fact, all three of these scenarios in this example have the same expected return, but owning one share of each has the lowest expected risk. This makes Option 3 the best choice.

Looking beyond two stocks

Okay, this example was intentionally simple to demonstrate the concept. But the same idea can be extended to more realistic scenarios. And in general, you can reduce how much your portfolio fluctuates in value by diversifying.

Over any given period of time, some of your investments might decrease in value, but others will (hopefully) increase, helping to stabilize your overall wealth.

Alternatively, you might have a situation where all of your investments fall in value – for example a financial crash. But some of your investments might fall less than others, which will also help to reduce the swings in your wealth. In fact, as long as your investments aren’t perfectly correlated (meaning they move in perfect lock step with one another), you can lower your investment risk by diversifying your holdings.

More to come: This is just the tip of the iceberg for diversification. We’ll cover more details in our guides on Investing.

Key Take-Aways

1) Diversification is about spreading your money around and can help protect you from a single investment going badly.

2) Diversification can also help reduce the fluctuations in your wealth over time.

3) As long as your investments don’t move in perfect lock-step with one another, diversification can reduce your risk.

Sign up to see the rest of this article!