What’s the Big Deal with GDP Anyway?

This week, the Bureau of Economic Analysis released the second quarter GDP report (April through June). And as you can imagine, it wasn’t pretty.

The results showed GDP shrank by nearly 33% for the quarter, or roughly $2 trillion.

For comparison, total annual GDP for 2019 was about $21.5 trillion (so for one quarter it would have been about $5.5 trillion). Long story short, almost one third of the economy was out of commission for April through June. Yikes.

Now this probably doesn’t come as much of a surprise, given all the shut downs and business restrictions. And the drop was roughly in line with what economists and Wall Street analysts were predicting. But it does illustrate just how big the impact has been already. And while much of the economy has reopened since then, we’re still facing some serious challenges. So let’s dig into what this means.

What’s GDP all about?

The Gross Domestic Product, or GDP for short, is a measure of all the goods and services produced in an economy. Basically, it serves as a snapshot for economists and policy makers to assess the health of the economy. Rising GDP, growing economy = good (roughly speaking). Shrinking GDP, you guessed it, shrinking economy = bad.

But total GDP only tells you part of the story. If GDP is growing but the population is also growing, that doesn’t really mean the country is getting any richer (more wealth is being created but it’s spread across more people).

So economists like to look at GDP per capita – ie GDP divided by the total number of people in a country. It tells you how much total wealth is produced per person, and paints a better picture for how a nation’s wealth is actually changing over time. Basically, growing GDP per capita means an economy is getting more efficient at producing goods/services. Which generally translates to improved living standards.

Tracking GDP over time

While the level of GDP or GDP per capita is important, it’s the growth rate of GDP that’s really of interest to economists and policy makers.

Because that tells you how the economy is changing (for better or worse). And to understand that, we need to look at how GDP changes over time.

But, as you know, inflation can make this comparison a little misleading (a dollar today is worth less than it used to be). So economists track something called real GDP – GDP numbers that have been adjusted for inflation. That way, comparisons from one year to the next are apples to apples.

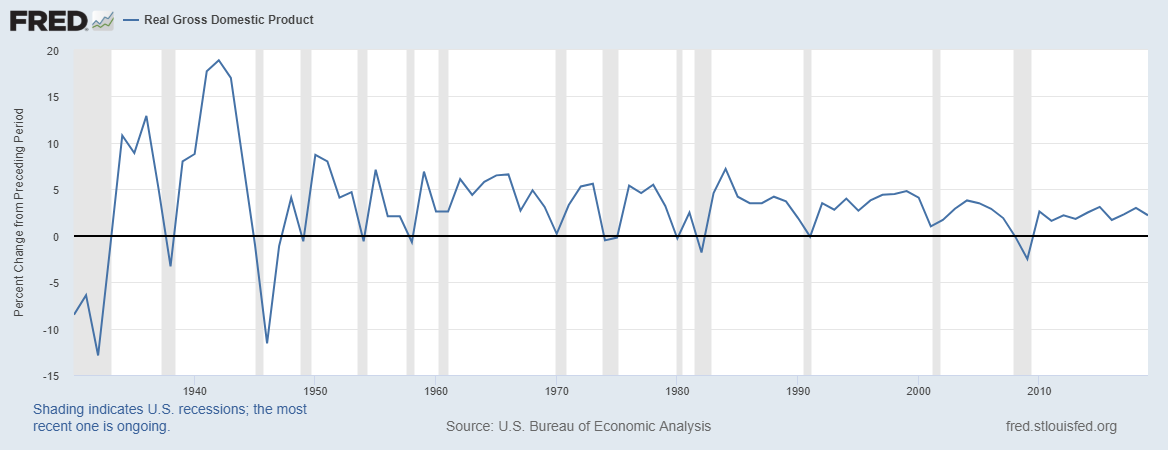

Without getting too mathy, here’s a chart provided by the Federal Reserve showing the annual growth rate of real GDP since 1930. In other words, it shows the amount GDP has grown each year, reported as a percentage increase/decrease.

A few things to note. The GDP growth rate tends to fluctuate from one year to the next (the zig zaggy shape of the line). It also tends to fall between 0% and 5% a year. Typically somewhere around 1-3%. So the 33% drop we saw in Q2 was MASSIVE. In fact, it’s the largest quarterly drop in recorded history, including the Great Depression and Great Recession. Keep in mind though, this was only for one quarter, and many businesses have reopened since then. But it’s pretty clear it will take some time to fully recover.

So what does all this mean for you and your finances?

Well, this is where it gets a little tricky. In some ways, it actually doesn’t mean a whole lot. Stocks and other investments are surprisingly less impacted by GDP fluctuations than we typically think. And if you’re saving/investing for several decades, the periodic ups and downs are just going to be a part of the process. You shouldn’t really be changing your investing strategy based on what the economy has done or what you think it might do.

But on the other hand, a bad economic environment can have a real impact on our jobs and lives. Unemployment rises, companies go out of business, and economic uncertainty starts to dominate the public narrative. And this can lead to a nasty downward spiral and serious financial challenges for everyone.

So, long story short, we should all probably be a little more careful with our finances. Whether it’s ensuring your emergency fund is secure or cutting back on less essential expenses for a while. It’s generally just a good idea to be more financially secure when we’re facing such uncertainty. Maybe you won’t be affected, but you want to at least be prepared.

Anything else we can help you with?

► What to do if you’ve been laid off

► Your COVID-19 Financial Playbook

► Learn about investing with our Investing Cheat Sheet